Why Diversification is one of the Seven Deadly Investment Sins

Diversification. The investment strategy most investment advisors recommend— mainly because they don’t know what they’re doing

At first glance, you’d think that great investors like Warren Buffett and George Soros have little or nothing in common.

Buffett’s trademark is buying great businesses for considerably less than what he thinks they’re worth—and owning them “forever.” Soros is the archetypal speculator, famous for making huge, leveraged trades in the currency and futures markets.

No two investors could seem more opposite. Yet there are a surprising number of mental habits and strategies they both share—traits that underlie their amazing success.

For example, they are both highly risk-averse—but they never diversify their investments.

This sounds like a contradiction in terms. Surely, if you don’t diversify, you must be taking more risk. Doesn’t just about every investment advisor, broker and financial planner recommend diversification as the best, if not the only way, you can protect yourself from losing money in the markets?

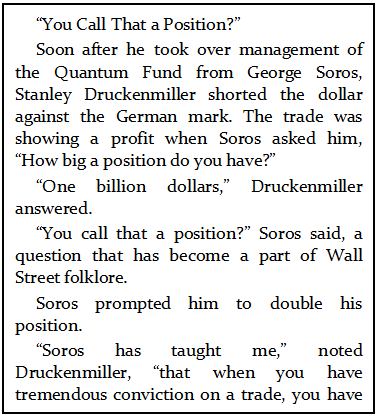

When Buffett and Soros decide to make an investment, they always buy as much as they can. Buffett has had as much 35% of his assets in a single stock. Soros sometimes builds speculative positions that exceed his entire net worth. And another great investor, Carl Icahn, has on occasion had all his assets in just one stock!

What’s more, analyzing their past investments proves that always buying as much as they can is how they built their incredible fortunes . . . from nothing.

If they’d practiced diversification, we’d never have heard of them.

How can this be? How come investment professionals—the people who after all should know best—tell us we must diversify, while the world’s most successful investors do the exact opposite?

First, let’s consider what diversification really means.

Compare two portfolios. The first is diversified among one hundred different stocks; the second is concentrated, with just five.

If one of the stocks in the diversified portfolio doubles in price, the value of the entire portfolio rises just 1%. The same stock in the concentrated portfolio pushes the investor’s net worth up 20%.

For the diversified investor to achieve the same result, twenty of the stocks in his portfolio must double—or one of them has to go up 2,000%. Now, what do you think is easier to do:

1. identify one stock that’s likely to double in price; or

2. identify five stocks that are likely to double?

No contest, right?

Of course, on the other side of the coin, if one of the diversified investor’s stocks drops in half, his net worth only declines 0.5%. If the same thing happens in the second portfolio, the concentrated investor sees his wealth drop 10%.

But let me ask you the same question again . . . which is easier to do:

3. identify 100 stocks that are unlikely to fall in price; or

4. identify five stocks that are unlikely to fall in price?

Same answer: no contest.

So diversification is a great risk-avoidance strategy. But it has one unfortunate side-effect: by its very nature, it’s also a great profit-avoidance strategy—which is why I call it one of the Seven Deadly Investment Sins.

As Fortune magazine once put it: “One of the fictions of investing is that diversification is a key to attaining great wealth. Not true. Diversification can prevent you from losing money, but no one ever joined the billionaire’s club through a great diversification strategy.”

Fair enough. But the underlying assumption of the adviser who tells us to diversify is that the only alternative is to take too much risk. Which is certainly the advice they’d give you if—like Carl Icahn—you wanted to put all your money into just one stock.

For a moment, let’s move our attention from investors and investing to successful businessmen. Did Bill Gates, for example, start several businesses at once to be sure of success?

Of course not! We know almost intuitively that if someone is going to build a successful business, he has to focus on just that business and nothing else pretty much 24 hours a day for ten, even twenty years. And that if he started out with two or three different businesses, he’d fail at every one for sure.

It’s quite true that many new businesses fail. But every business consultant advises their clients to not even think about entering a second business until, at the very least, they’ve made their first business successful. Furthermore, they all stress, success depends on focusing their attention and concentrating their energies in as narrow a field as possible.

And that’s exactly what the great investors do.

One other thing to keep in mind is that for the Buffetts and Soroses of this world, investing is their bread and butter—and their life’s work. To them taking a loss, no matter how small, is like taking a pay cut: something to be avoided at all costs.

So their first aim is always to avoid risk, and they work hard to ensure that for every one of their investments, their risk of loss is minimal to non-existent. Only then do they worry about profits.

How can they be risk-averse, yet never diversify? By using risk-control methods that your Wall Street advisor has probably never heard of—but are far more effective than diversification.

Warren Buffett, for example, waits until he finds an investment that, to him, is a bargain. When he finds a company he can buy at 50 to 75 cents in the dollar, he acts like the supermarket shopper who sees her favorite soap on sale at 50% off and loads up her trolley with as much as she can.

Which is exactly what Buffett does when he finds a company “on sale” at 50% off.

Of course, unlike your neighborhood supermarket, the stock market never runs an ad to tell you when a company is on sale at a bargain price.

The great investor has to find such bargains himself. So he spends nearly all his time and energy searching for opportunities that he is sure will make him a bundle of money with minimal risk.

Investments like these are very difficult to find. Who knows when he’ll come across the next one? What’s the point in sitting on a pile of cash waiting for an opportunity that may be a long time coming when, right now, he can see piles of money sitting on the table, begging to be scooped up?

That’s why when Buffett and Soros buy, they buy big.

Bernard Baruch's advice is worth repeating: “It is unwise to spread one’s funds over too many different securities.”

Or as Warren Buffett puts it: “Diversification is a protection against ignorance. [It] makes very little sense for those who know what they’re doing.”