Hedge Fund Implosion!

Could it happen to you? Even if you’re not sure how to spell “hedge fund,” the answer is “yes.”

In September 2006 a then-major hedge fund, Amaranth Advisors, imploded, losing some $5.5 billion or 60% of its assets in just a few days.

Ouch!

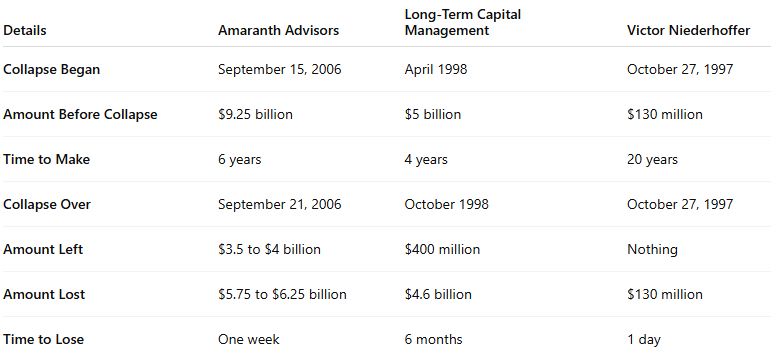

Amaranth joined a long list of major operators like Long-Term Capital Management and Victor Niederhoffer who’ve lost a bundle of money in next to no time flat.

This table shows what can happen to an investor whose investment strategy is incomplete:

What Happened

Amaranth was a hedge fund that, according to a January 2006 offering statement, had returned an annual average of 14.72% to investors between September 2000 and November 2005, after all fees.

In the first half of 2006, it had made juicy profits trading in the energy markets.

The trade that led to its downfall was a spread between the March 2007 and April 2007 natural gas contracts. The theory: that natural gas prices were going to rise, and as they did the spread would widen.

This is, indeed, what happened . . . for a while. Natural gas prices had risen over the previous couple of years, and the spread had widened to as much as $2.50 in early September, just as the fund managers expected.

Then the energy markets collapsed, and the spread narrowed from $2.50 to 50 cents.

Why It Happened

Okay, they got it wrong. Natural gas prices dropped along with oil and other commodities (wasn’t it a nice change to see the price signs outside of gas stations dropping from one day to the next?).

Worse, of course, was that the spread had narrowed instead of widening. And Amaranth had made extensive use of margin to load up on their positions.

But that’s not the fundamental reason Amaranth imploded. (So if you’re not quite sure what spreads are or how they work, don’t worry about it. Neither spreads nor natural gas futures are the real issue here.)

Investors make mistakes all the time. As the sage “Anonymous” put it, prediction is difficult, especially when it concerns the future.

The successful investor makes money despite his mistakes.

How?

By making sure his mistakes don’t kill him.

First, he’s always on the lookout for mistakes and takes immediate action to correct them. To its credit, Amaranth did follow this practice. They sold off their natural gas spreads, along with some other assets (at a loss), thus swallowing the loss but protecting their remaining assets from further deterioration . . . and ensuring that they stopped getting margin calls.

If they hadn’t taken that action, they would have been squeezed as the vultures circled around waiting for them to liquidate positions at fire sale prices to pay off their debts.

But more to the point, Amaranth clearly lacked a fully formed exit strategy.

What is an exit strategy? In a nutshell, it’s the Boy Scout approach to investing: Be Prepared. Investors like Warren Buffett and George Soros never make an investment unless they know exactly what will cause them to sell it.

Being Prepared

Be prepared for what? For everything and anything that could happen.

For example, a market meltdown.

Let me ask you: if all the world’s markets collapsed tomorrow—1929 or 1987 or 2008 all over again—what would happen to your investments? What would happen to your net worth? Have you ever thought about, and prepared for such a possibility?

Amaranth hadn’t. If they had, they would have considered these possibilities:

1. Position sizing is ensuring that no position in your portfolio is so big that in the worst case scenario, it can bring the house down.

2. The market’s liquidity. To take a profit—or protect yourself from a loss—you have to be able to get out without affecting the price. So you must ensure your position is not so big that it dominates the market.

In the normal course of events, even large hedge funds can liquidate large positions in most markets without too much trouble. It’s always the worst case scenarios that can kill them—and you.

At the best of times, liquidity in the natural gas futures market (i.e., the number of buyers and sellers) is relatively low. The liquidity in Amaranth’s spreads was even thinner. When gas prices collapsed the liquidity for Amaranth’s spreads effectively disappeared: it could only liquidate its positions at give-away prices.

3. Leverage. The ultimate killer for Amaranth was its use of leverage. If it had paid cash for these spreads, it could have just sat on its losing positions until the market’s liquidity returned. Maybe it would still have had to get out at a loss, but the loss would have been a lot smaller, and they could have ridden out the storm.

But because it was using margin—too much margin—when the value of its spreads, which was the collateral against its loans, collapsed, banks and brokers came knocking on Amaranth’s door demanding their money now.

The same kind of thing happens to small investors when they can’t pay the mortgage and the bank takes their house. In the futures markets, your juicy profits can disappear a helluva lot faster.

Investment AIDS

This, by the way, is exactly the same scenario that brought down Long-Term Capital Management and Victor Niederhoffer.

Indeed, investing without being prepared is like having sex with a stranger without protection. Without a solid exit strategy covering all conceivable possibilities, you can walk away with significant losses or a (sometimes terminal) STD.

You might be thinking you’re immune to such problems because you don’t have money in a hedge fund, don’t trade futures or options, and never use leverage.

Think again.

Being prepared to take a profit is just one element of an exit strategy: and for too many investors, that’s where their planning stops. Unfortunately, there are a dozen or two other possible outcomes for any investment you care to name, all variations on the theme of losing money.

Without a fully-formed exit strategy, the chances are that you’ll join the ranks of the losing investors. If not today, then tomorrow. Perhaps your investments won’t melt down and send you to the poorhouse. But seeing your net worth shrink “only” 20% to 30% in a matter of weeks or months is small consolation.

Being prepared for a market meltdown is one of many features of a fully-fledged exit strategy. As I devoted an entire chapter of The Winning Investment Habits of Warren Buffett & George Soros to this subject I won’t repeat myself here. A chapter which, according to Dr. Mark Skousen, editor of the Forecasts & Strategies investment newsletter, “alone is worth the price of the book.”

By the way, if you’ve already read The Winning Investment Habits of Warren Buffett & George Soros, as a “thank you” you can download My Favorite Wealth-Building Secret, which goes even deeper into exit strategies, at www.marktier.com/bonus.